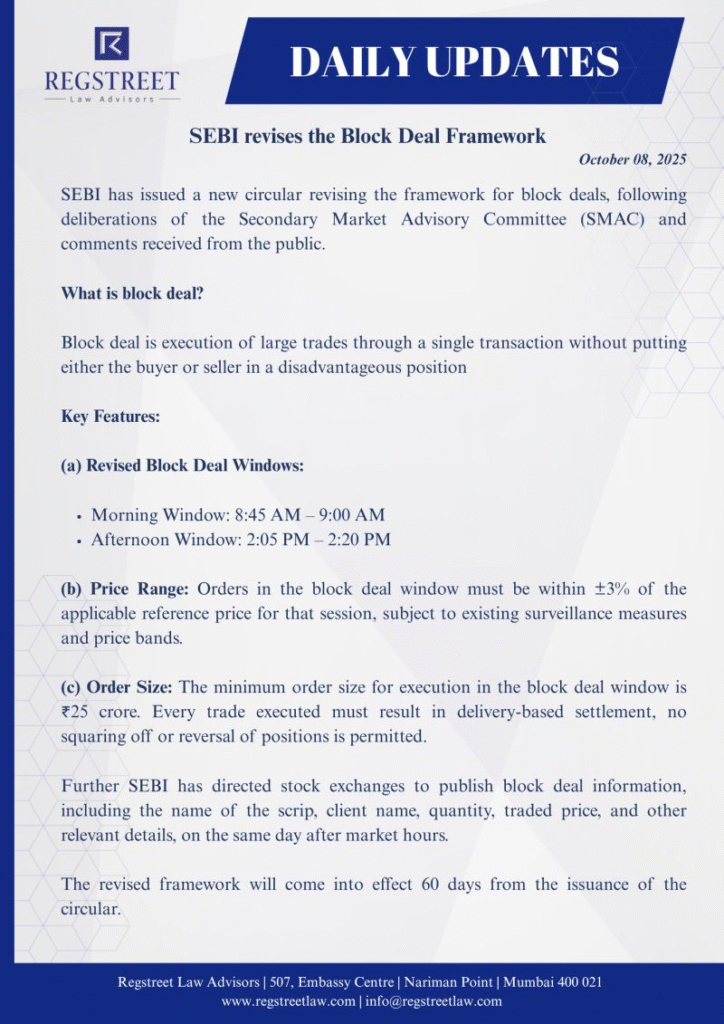

SEBI has issued a new circular revising the framework for block deals, following deliberations of the Secondary Market Advisory Committee (SMAC) and comments received from the public.

What is block deal?

Block deal is execution of large trades through a single transaction without putting either the buyer or seller in a disadvantageous position

Key Features:

(a) Revised Block Deal Windows:

• Morning Window: 8:45 AM – 9:00 AM

• Afternoon Window: 2:05 PM – 2:20 PM

(b) Price Range: Orders in the block deal window must be within ±3% of the applicable reference price for that session, subject to existing surveillance measures and price bands.

(c) Order Size: The minimum order size for execution in the block deal window is ₹25 crore. Every trade executed must result in delivery-based settlement, no squaring off or reversal of positions is permitted.

Further SEBI has directed stock exchanges to publish block deal information, including the name of the scrip, client name, quantity, traded price, and other relevant details, on the same day after market hours.

The revised framework will come into effect 60 days from the issuance of the circular.

The SEBI Circular is available at https://lnkd.in/gth4zbnc

Readers are welcome to share their views with Regstreet Law Advisors at info@regstreetlaw.com